The commercial real estate crisis is a pressing concern for investors and financial experts as high office vacancy rates continue to plague urban markets. With demand for downtown office spaces drastically reduced post-pandemic, many cities report vacancy levels soaring between 12 to 23 percent, thereby eroding property values. Coupled with the looming repayments of over $4.7 trillion in commercial mortgage debt, banks are bracing themselves for potential failures if major delinquencies occur. The Federal Reserve’s ongoing reluctance to lower interest rates exacerbates these anxieties, as soaring borrowing costs create a precarious situation for struggling investors. As high vacancy rates threaten financial stability, the implications for the broader U.S. economy are profound, leaving many to question how sustained bank failures might reshape market dynamics and consumer confidence.

As we navigate the turbulence in the market, the current challenges in commercial property financing can also be referred to as the commercial real estate downturn. This slump is characterized by rising vacancy levels in office spaces, which have dramatically increased after the pandemic shifted workplace dynamics. With banks facing an influx of maturing loans coupled with stringent interest rates, the potential for substantial financial fallout looms large. Market analysts are increasingly concerned about how the cascading effects of potential bank failures could disrupt the economy. Amidst these challenges, understanding the intricate relationship between real estate investment and financial stability becomes essential for mitigating future risks.

Understanding the Commercial Real Estate Crisis

The commercial real estate crisis is primarily driven by soaring office vacancy rates across major urban centers, which have dramatically changed the landscape of the U.S. economy. As the trend for remote work continues to solidify, demand for traditional office spaces has plummeted, leading to an alarming oversupply in the market. Boston, for instance, has office vacancy rates nearing 23%, indicating a significant decline in property values and investments. As businesses grapple with this excess capacity, the risk of defaults on commercial real estate loans looms larger, particularly among smaller and regional banks that lack the robust regulations imposed on larger financial institutions.

Moreover, the impending maturity of a substantial portion of commercial mortgage debt heightens concerns of widespread bank failures. An estimated 20% of the $4.7 trillion in commercial mortgage debt is set to come due this year, creating a ticking clock for many property investors. With high office vacancy rates and rising interest rates, the financial stability of banks heavily invested in real estate could be jeopardized, leading to a cascade of financial distress throughout the economy. This scenario underscores the critical state of the commercial real estate market and its potential ripple effects on overall economic health.

The Impact of Office Vacancy Rates on the Economy

High office vacancy rates exert a negative influence on the economy, creating a ripple effect that can impact various sectors. When businesses downsize or close their office spaces, it leads to decreased demand for related services, such as maintenance, cleaning, and utilities. This, in turn, affects jobs in those industries, contributing to unemployment and reduced consumer spending. As workers lose their jobs or face wage stagnation, local economies suffer from diminished purchasing power, which can stifle economic growth even further.

Additionally, increased vacancy rates trigger a downward spiral in property values. As owners struggle to rent out their spaces, they may be compelled to reduce lease prices, which negatively affects the market’s overall valuation. This trend can burden existing property owners with underwater mortgages, especially in cases where loans are due soon. With many banks holding high stakes in these commercial real estate loans, any significant downturn will likely pose capital challenges, potentially leading to stricter lending practices and further contractions in the economy as banks become more cautious in their lending approach.

Consequences of Rising Interest Rates

Rising interest rates are a significant factor in the current challenges facing the commercial real estate sector. As rates climb, the cost of borrowing increases, putting additional financial strain on property owners who rely on loans to manage their investments. Many real estate investors initially took advantage of low-interest rates to finance large acquisitions, but with rates now rising, refinancing loans or taking on new debt has become a more arduous task. This shift can result in a higher likelihood of defaults as investors struggle to keep pace with their financial obligations amidst dwindling revenue from vacant properties.

Higher interest rates also create a less favorable environment for new investments in commercial real estate. Investors may become hesitant to enter the market due to dismal yield expectations, especially for office spaces with high vacancy rates. The resulting slowdown in activity can further compound issues for existing loans, as the market fails to recover and property values continue to decline. Consequently, this situation poses a dual threat to the U.S. economy, as both financial institutions and property owners grapple with the fallout from escalating interest rates.

The Role of Banks in Real Estate Financing

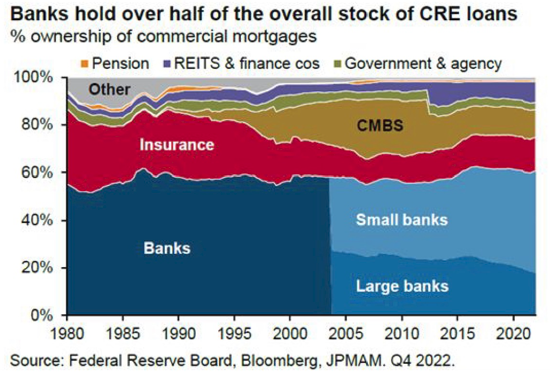

Banks play a crucial role in financing commercial real estate, and their exposure to high office vacancy rates is a significant concern. According to reports, commercial loans represent about a quarter of many lenders’ assets, making them especially vulnerable to downturns in the real estate market. If office vacancies continue to soar and property values plummet, banks may face increased delinquency rates on loans, leading to potential bank failures—particularly among smaller institutions that do not possess the same capital buffers as larger banks.

The landscape of real estate financing is changing, and financial institutions are closely monitoring market responses to economic conditions. Some experts predict that the looming wave of commercial real estate loans maturing could cause regional banks to struggle significantly. A heightened risk of delinquent loans may lead to stricter lending practices and tighter credit conditions, creating a challenging situation for consumers and businesses alike. Effectively managing these risks will be vital for banks and policymakers to prevent a cascading effect from destabilizing the broader economy.

Pension Funds and Their Exposure to Real Estate Losses

Pension funds have a significant investment in commercial real estate, and rising office vacancy rates present a serious risk to these funds. Many pension plans rely on returns from real estate investments to deliver promised benefits to retirees. However, as property values decline and rental income diminishes due to high vacancy rates, pension funds face a difficult predicament. Substantial losses in these investments could lead to reduced payouts or require increased contributions from employees and employers, straining financial resources.

Furthermore, the interconnectedness of pension funds and banks creates a pathway for the commercial real estate crisis to extend beyond just the property market. If pension funds experience severe losses, this can lead to a liquidity crisis for banks that heavily invest in similar assets. The potential for widespread losses across these financial sectors highlights the precarious balancing act that funds and banks must navigate amidst ongoing uncertainties in the real estate market.

The Future of Commercial Real Estate: Opportunities Amidst Challenges

Despite the hurdles posed by high vacancy rates and rising interest rates, there are elements of opportunity within the commercial real estate sector. Certain segments, such as those offering sustainable and high-quality buildings, are still experiencing demand from businesses looking for compliant and healthy work environments. Buildings featuring upgraded ventilation and energy efficiency could see increased interest as companies prioritize employee well-being in the post-pandemic world. Capitalizing on this trend could help stabilize some areas within commercial real estate, even when others struggle.

Furthermore, the prospect of repurposing vacant office buildings into residential units presents an opportunity for innovation in urban planning. While challenges such as zoning laws and building design hinder conversions, tackling these obstacles might provide a solution to both the housing shortage and the surplus of commercial space. By fostering policies that encourage such transformations, municipalities can pave the way for a brighter future for commercial real estate, potentially mitigating the adverse effects of economic downturns on the sector.

Potential Impact of Regional Bank Failures on Communities

The potential failure of regional banks due to rising delinquency rates in commercial real estate poses significant repercussions for local communities. These banks often serve as the financial backbone for small businesses, providing loans that support economic activity and employment. If regional banks collapse or curtail lending due to excess exposure to delinquencies, communities may face increased unemployment and reduced economic growth. The subsequent tightening of credit can stunt local businesses’ ability to expand or maintain operations, exacerbating economic challenges.

Moreover, the ramifications of regional bank failures extend beyond immediate job losses; they can diminish consumer confidence in the financial system. Local economies depend on a stable banking infrastructure to support both personal and commercial financial activities, and any instability can lead to reduced spending and investment. This scenario highlights the intricate relationship between commercial real estate health and the overall vitality of community economies, emphasizing the need for proactive measures to address the underlying issues of vacant properties and their broader implications.

Mitigating the Risks of a Real Estate Downturn

In light of the rising issues linked to commercial real estate, several strategies can be employed to mitigate potential risks and foster economic resilience. Policymakers and industry leaders must consider forging partnerships that focus on sustainable urban development and adaptive reuse of existing properties. By incentivizing the repurposing of outdated office spaces into functional residential buildings, cities can alleviate some of the financial strains while addressing pressing housing shortages. These collaborative efforts can energize local economies and help stabilize commercial markets.

Another vital approach is enhancing the financial literacy of investors and business owners regarding long-term economic conditions and potential market changes. Providing resources to help them understand the impact of interest rates and vacancy rates can lead to more informed decision-making. Encouraging prudent investment practices and diversifying portfolios can help mitigate risks associated with heavy exposure to commercial real estate, ultimately fostering a more resilient economic landscape capable of withstanding downturns.

Frequently Asked Questions

How do high office vacancy rates contribute to the commercial real estate crisis?

High office vacancy rates are a significant factor in the commercial real estate crisis as they lead to decreased property values and lower rental income. Many businesses have shifted to remote work post-pandemic, causing demand for office space to plummet. As vacancies in cities range from 12% to 23%, property owners struggle to maintain their investments, potentially leading to defaults on commercial real estate loans.

What impact do rising interest rates have on the commercial real estate crisis?

Rising interest rates exacerbate the commercial real estate crisis by increasing borrowing costs for investors and property developers. As interest rates rise, refinancing existing real estate loans becomes more difficult, potentially leading to increased delinquencies and foreclosures within the sector, thereby impacting the wider U.S. economy.

Are bank failures a risk due to the commercial real estate crisis?

Yes, bank failures are a risk due to the commercial real estate crisis, particularly for smaller and medium-sized banks heavily invested in commercial real estate loans. As these loans mature and delinquencies rise, banks may face significant losses. However, larger banks are better shielded due to stricter regulations post-2008 financial crisis, reducing the likelihood of widespread bank failures.

How could the commercial real estate crisis affect the overall U.S. economy?

The commercial real estate crisis could negatively impact the U.S. economy through reduced lending conditions and increased bankruptcies among regional banks. This economic distress can lead to reduced consumer spending and overall slower economic growth, even as other sectors remain strong. If a significant recession occurs alongside the crisis, it could further exacerbate the economic fallout.

What measures can be taken to mitigate the commercial real estate crisis?

To mitigate the commercial real estate crisis, it is essential to lower long-term interest rates, which would facilitate refinancing and help stabilize property values. Additionally, adjusting zoning laws to allow for the conversion of vacant office spaces into residential properties could help reduce vacancies and enhance demand in this sector.

How do real estate loans impact the commercial real estate crisis?

Real estate loans are central to the commercial real estate crisis, as many loans are maturing in a challenging economic environment. High vacancy rates and rising interest rates increase the risk of loan delinquencies, which could lead to financial instability for banks that hold these loans, thereby implicating broader financial systems.

What sectors of commercial real estate are still thriving amid the crisis?

Despite the commercial real estate crisis, some sectors, such as super-premium office buildings with high health and safety features, remain attractive to investors. These properties typically have higher occupancy rates and demand, providing some stability in an otherwise struggling market.

What should investors know about the potential for a commercial real estate crisis in the coming years?

Investors should be aware that the commercial real estate crisis could persist as a slow-moving issue, particularly with a significant wave of loans maturing by 2025. While widespread failures are not guaranteed, vigilance in assessing both market conditions and the financial health of borrowers is crucial during this uncertain economic period.

| Key Point | Details |

|---|---|

| High Office Vacancy Rates | Vacancy rates in major U.S. cities have reached between 12% to 23%, significantly affecting property values. |

| Impact on Banks | Many businesses are facing equity losses which may impact banks holding these debts, leading to potential bank failures, particularly among smaller and medium-sized banks. |

| Upcoming Debt Maturity | 20% of the $4.7 trillion in commercial mortgage debt is due this year, raising concerns about delinquencies and their ripple effects on the banking sector. |

| Government Intervention | The Fed has shown a willingness to bail out distressed institutions, which could mitigate some risks. |

| Broader Economic Context | Despite the challenges in commercial real estate, the overall economy remains strong, supported by a solid job market and a robust stock market. |

| Potential Solutions | Falling long-term interest rates or a significant recession could allow for refinancing, but these scenarios are uncertain. |

| Relative Preparedness of Large Banks | Larger banks are well capitalized and diversified, decreasing the likelihood of a widespread financial crisis akin to 2008. |

Summary

The ongoing commercial real estate crisis presents significant challenges for the economy as high office vacancy rates impact property values and the stability of banks. Although fears of a widespread banking meltdown exist, particularly among smaller financial institutions, the overall soundness of economic fundamentals may prevent a broad systemic collapse. Policymakers and investors are closely monitoring the situation as a substantial portion of commercial mortgage debt matures, with the potential for tightening lending conditions and regional economic distress. Balancing the dynamics of commercial real estate and broader economic health remains crucial in navigating this evolving crisis.